Recently, Doo Prime’s sister company, Doo Financial Australia Limited, has successfully purchased Professional Liability Indemnity Insurance (PII) from Lloyd’s of London for its principal with a specific underwriter to meet its obligations as an Australian Financial Service Licensee (AFSL).

Partnering With The World’s Leading Insurance Experts

With more than 300 years of history, Lloyd’s of London has developed into the world’s leading insurance and reinsurance market. As one of the prestigious insurance experts, Lloyd’s of London is comprised of over 50 internationally recognized insurance companies, over 380 Lloyd’s registered brokers and more than 4,000 locally authorized underwriters worldwide. Its professional insurance intermediaries system has unparalleled underwriting skills and expertise in specific risk areas, allowing it to tailor robust and inclusive solutions for a broad range of complex risks, thereby enhancing the business’s resilience to market risks.

Up to now, Lloyd’s has provided professional underwriting services to individuals, businesses and communities in more than 200 countries and territories, covering more than 60 types of insurance. To be able to partner with Llyod’s has also become a strong credibility endorsement for a company.

Purchase of PII Ensures Regulatory Compliance

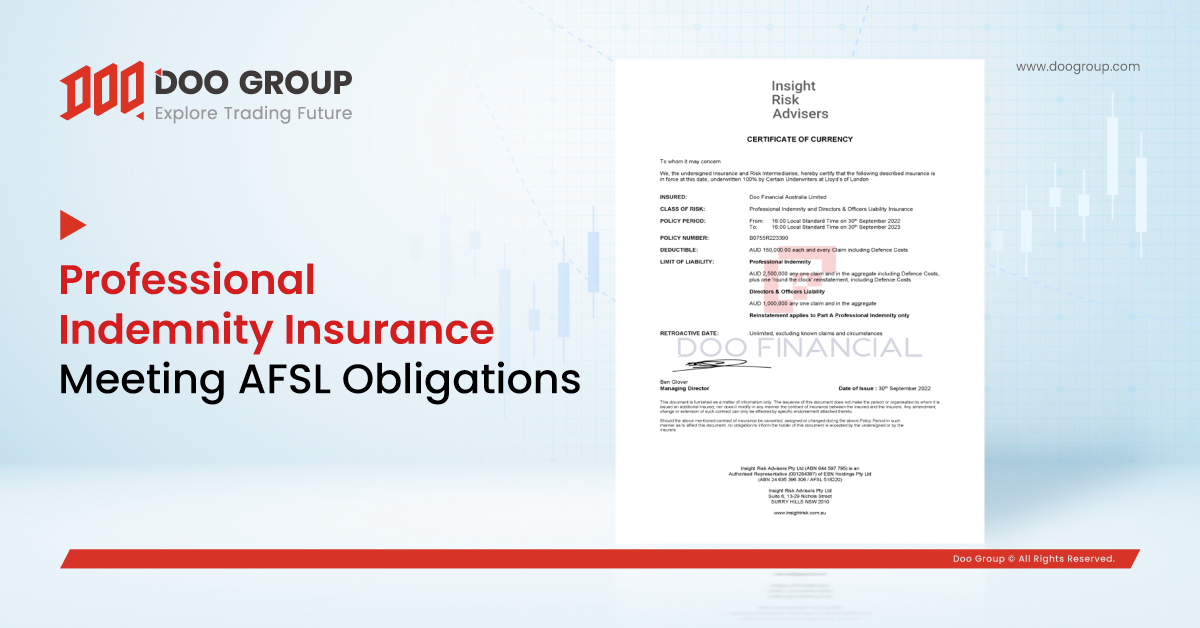

The Australian Securities and Investment Commission (ASIC) has set out many obligations that ASFLs must meet to ensure compliance. While these obligations can be costly and onerous at times, Doo Financial Australia Limited believes it is vital to comply with all relevant laws and regulation which includes adequate compensation arrangements. As such, Doo Financial Australia Limited has purchased Professional Indemnity Insurance (PII), which is underwritten by the world’s leading Lloyd’s insurance experts. This PII ensures Doo Financial Australia Limited has the financial capital to indemnify the client in the event of a claim against Doo Financial Australia Limited subject to its terms, conditions, and exclusions.

Professional Indemnity Insurance, also known as “Professional Liability Insurance”, is a framework based on internationally applicable standards of practice, knowledge and ethical practice.

The PII signed by Doo Financial Australia Limited is effective as of 30th September 2022 and will continue to provide coverage during the validity period. This policy covers any loss or damage caused by the entity to the client up to a maximum liability limit of AUD 2.5 million.

As a financial company, being a compliant AFSL is not only our core responsibility but also our eternal core value pursuit so that our customers can continue to trust in the services that we provide.

In the future, Doo Group will continue to practice higher standards of regulatory compliance in the financial industry. It strives to create a reliable trading environment with cutting-edge technology, rich experience and professional services, providing global investors with a convenient and reliable investment experience to achieve one-click allocation of global financial assets.

About Doo Prime

Doo Prime is an international pre–eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Commodities, Stock Indices, and Funds. At present, Doo Prime is delivering the finest trading experience to more than 60,000+ professional clients, with an average monthly trading volume of USD51.223+ billion.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.